Navigating the Odyssey of Wealth

A Guide for Ultra-Affluent FamiliesEmbarking on the journey of estate planning, you’re not just charting a course for assets; you’re drawing a blueprint of values, aspirations, and legacy. As an ultra-affluent family, your odyssey can involve even more intricate layers, with expansive wealth and unique lifestyles adding to the complexities. The Pantheon Process is here to help you navigate these complexities with ease and confidence.

The Pantheon Mindset

In the realm of cognitive approaches, a Pantheon Mindset involves embracing diverse perspectives, ideas, and sources to gain a holistic understanding. It encourages open-mindedness, active listening, and exploring ideas beyond traditional boundaries. By valuing diversity and collaboration, it helps foster creative problem-solving and decision-making. This approach can be beneficial in complex problem-solving, strategic planning, and decision-making by leveraging collective intelligence to drive innovative solutions. The Pantheon Mindset helps promote an integrative approach to information processing, emphasizing multiple viewpoints for a deeper understanding of complex topics.

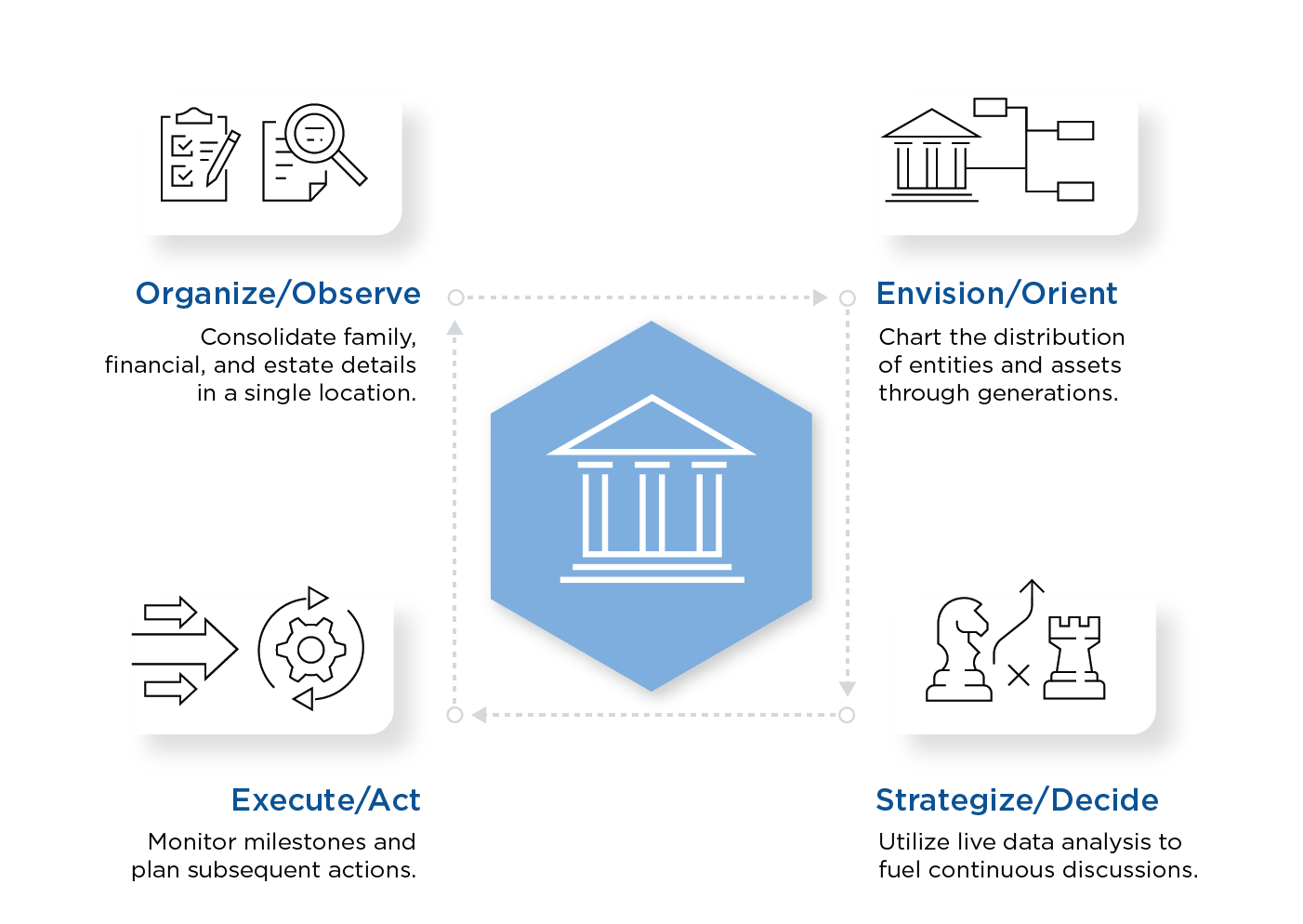

The Pantheon Process

The Pantheon Process is a targeted estate planning approach for ultra-affluent families. This comprehensive framework helps navigate wealth management and legacy planning complexities, emphasizing continuous review and adaptation. The practical application of a Pantheon Mindset involves integrating the OODA Loop as its foundational and guiding principle and process.

Organize ➜ Observe

Think of organizing as the first step in a grand journey. It’s not merely about gathering documents and information. It’s about laying the groundwork. Every document, every detail is a puzzle piece that contributes to the bigger picture.

This stage begins with a deep dive into understanding your family dynamics, financial health, and visions for estate planning. It then progresses to the review of essential estate planning documents, like wills, health care proxies, and powers of attorney. These are the pillars that uphold the integrity of any estate plan. They are not just pieces of paper but a testament to your foresight and stewardship.

Envision ➜ Orient

Then comes the visualization phase. Here, we assemble the pieces to form a coherent picture of your estate. With all relevant data at hand, we paint a comprehensive balance sheet that includes everything from real property to digital assets. This process allows us to identify potential opportunities and adjustments, setting the stage for the strategic planning phase.

Strategize ➜ Decide

Armed with a clear picture of your assets, we move into the strategizing phase. Using the insights gained during the organizing and visualizing stages, we set out to craft a plan that resonates with your aspirations and values.

Are you concerned about taxable estates? Innovative strategies can be devised to shift money out of the taxable estate. Options such as life insurance placement, gifting, freezes, sales, and charitable planning can all be explored.

Execute ➜ Act

Finally, we come to execution. This is where the strategy comes to life. It’s where we implement the plans and review their effectiveness regularly. For those with taxable estates, exploiting the annual gift exclusion could be a beneficial move. And if gifts are made to a trust in your name, rest assured that notifications (Crummey letters) will be dispatched promptly.

Repeat ➜ Iterative Process

Estate planning for ultra-affluent families is an ongoing commitment. The Pantheon Process emphasizes the importance of regular reviews and updates to adapt to changing family dynamics, tax laws, and financial landscapes. These periodic assessments help to ensure that the estate plan remains effective and aligned with the family’s evolving objectives.

The Pantheon Process is a dynamic and highly personalized approach to estate planning that is designed to recognize the unique needs and challenges of ultra-affluent families. It is a collaborative effort between the family and a team of seasoned professionals who specialize in wealth management, legal matters, and taxation. By following this process, ultra-affluent families seek to ensure the preservation and responsible stewardship of their wealth for generations to come.